Casino Taxation

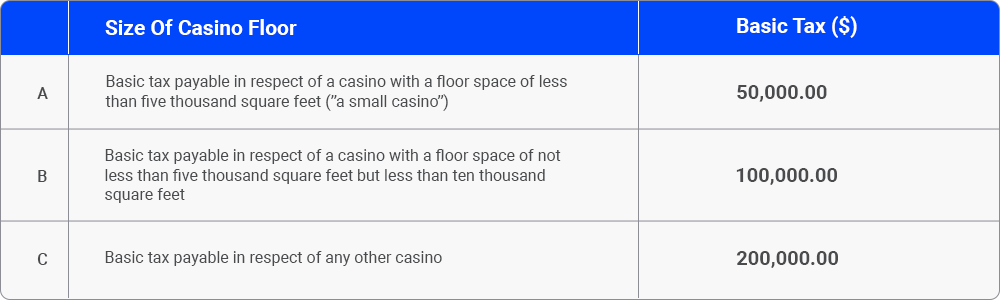

Basic Taxation (Regulation187)

In each and every year there shall be charged on and paid by the holder of a gaming licence in respect of a casino operated by it and open for business at any time during that year, the annual tax.

The basic tax payable by the holder of a gaming licence under the provisions of this regulation in any year, shall be paid in six equal monthly instalments, the first of which shall be due and payable on the thirty-first day of January of that year and the remainder each on the last day of each next succeeding month: Provided that where any casino is first opened for business during any year after the thirty-first day of January in that year, the basic tax payable in respect of that casino for that year shall be due and payable in such manner, whether or not by monthly instalments, as the Minister may in writing direct.

Gaming Tax Payable by Holder Of Gaming license (Regulation 188)

a) accounted for and calculated separately from any other taxable revenue referred to in regulation 188; and

b) subject to a fixed rate of tax of five per centum of adjusted gross revenue

The tax period in respect of the licence holders referred to in this Part shall be a period of one month ending on the last day of each of the twelve months of the calendar year; provided that any such tax period may, subject to the prior written approval of the Minister, end within ten days before or after such last day; provided further that, where applicable, the first tax period of any license holder shall commence on the date on which such license holder becomes licensed under the Act or on the date on which he would have become licensed had he qualified for licensing

Payment Of Taxes By The Holders Of Gaming, Proxy Gaming, Mobile Gaming And Restricted Interactive Gaming Licenses (Regulation 192)

1) The holders of gaming, proxy gaming, mobile gaming and restricted interactive gaming licences shall, within thirty days after the end of each tax period referred to in regulation 190 —

a) submit to the Board a tax return in such format and containing such information as the Board, after consultation with the Minister, may from time to time determine; and

b) pay into the bank account of the Board the amount of tax due to the Consolidated Fund calculated in the tax return referred to in paragraph (a).

2) Where a return referred to in paragraph (1) is inaccurate in any respect, the Secretary may remit such return to the licence holder and call upon the licence holder to resubmit an amended return.

3) The licence holder shall, within five days of receipt of an inaccurate return referred to in sub-regulation (2), submit an amended return to the Board, which shall replace the return submitted under paragraph (1).

4) Where applicable, upon submission of an amended return referred to in paragraph (3), the licence holder shall deposit into the bank account of the Board, any monies due to the Consolidated Fund in excess of the amounts paid over under paragraph (1)(b).

5) The Board shall within seven days of receipt of the tax referred to in paragraph (1)(b), or paragraph (4), as the case may be, pay such tax into the Consolidated Fund.

Penalty And Interest For Failure To Pay Tax When Due (Regulation 194)

If the gaming tax payable by a licence holder is not paid in accordance with the provisions of regulation 192, the licence holder shall pay a penalty on the amount of any outstanding tax at a rate of ten per centum of the tax for each week or part of a week during which the tax remains unpaid: provided that such penalty shall not exceed twice the amount of the tax in respect of which such penalty is payable: and provided further that where the Secretary, with the concurrence of the Minister, is satisfied that the failure on the part of any licensee to make payment of the tax within the prescribed period was not due to an intent to avoid or postpone liability for payment of the amount due, the Secretary may remit in whole or in part any penalty payable in terms of this regulation.

Gaming House Operator Taxation

Gaming Tax Payable By The Holder Of A Gaming House Operator Licence (Regulation 57)

1) Subject to paragraph (2), the gaming tax payable under section 64 of the Act by the holder of a gaming house operator licence shall be whichever is greater of —

a) eleven per centum of the taxable revenue; or

b) twenty-five per centum of earnings before interest, taxes, depreciation and amortization, generated by the operations conducted under its licence in any tax period.

2) The tax payable under paragraph (1) shall be subject to review—

a) eleven per centum of the taxable revenue; or

b) at such other time as the Minister may otherwise direct.

Tax Period (Regulation 58)

The tax period in respect of the licence holders referred to in this Part shall be a period of one month ending on the last day of each of the twelve months of the calendar year; provided that any such tax period may, subject to the prior written approval of the Minister, end within ten days before or after such last day; provided further that, where applicable, the first tax period of any licence holder shall commence on the date on which such licence holder becomes licensed under the Act or on the date on which he would have become licensed had he qualified for licensing.

Gaming Tax Payable By Holder Of A Gaming House Operator Licence (Regulation 57)

Penalty And Interest For Failure To Pay Tax When Due (Regulation 61)

If the gaming tax payable by a licence holder is not paid in accordance with the provisions of regulation 58, the licence holder shall pay a penalty on the amount of any outstanding tax at a rate of ten per centum of the tax for each week or part of a week during which the tax remains unpaid, provided that —

a) such penalty shall not exceed twice the amount of the tax in respect of which such penalty is payable; and

b) where the Secretary, with the concurrence of the Minister, is satisfied that the failure on the part of any licensee to make payment of the tax within the prescribed period was not due to an intent to avoid or postpone liability for payment of the amount due, the Secretary may remit in whole or in part any penalty payable in terms of this regulation.